Our Work

- Connect SoCal

- Inclusion, Diversity, Equity & Awareness

- Programs & Projects

- Housing

- Economy & Demography

- Federal & State Compliance

- Sustainability

- Transportation

- Active Transportation

- Aviation Program

- Regional Pilot Initiatives Program

- The Future Communities Initiative

- Transportation Demand Management

- Transit Program

- FreightWorks

- Passenger Rail Program

- Corridor Planning

- Transportation Safety

- Transportation Finance

- Intelligent Transportation Systems

- Southern California Transportation Study

- Local Resources

- Funding & Programming

- Legislation & Advocacy

- Publications & Reports

Transportation Finance

The Southern California Association of Governments’ (SCAG) Transportation Finance Program seeks to optimize the region’s transportation systems by planning for the long-term financial needs of the region. SCAG is working to address funding shortfalls by researching and promoting innovative financing techniques, and developing strategies for the Regional Transportation Plan (RTP), so that the greatest amount of transportation dollars are available to the region. In doing so, all forms of potential funding for transportation are analyzed and evaluated by SCAG.

2012-2035 RTP/SCS Financial Plan Highlights

You can access the financial plan chapter of the 2012-2035 RTP/SCS either via the iRTP version or as part of the 2012-2035 RTP/SCS print version in Adobe Acrobat PDF format. The Transportation Finance Appendix is also available as an Adobe Acrobat PDF file.

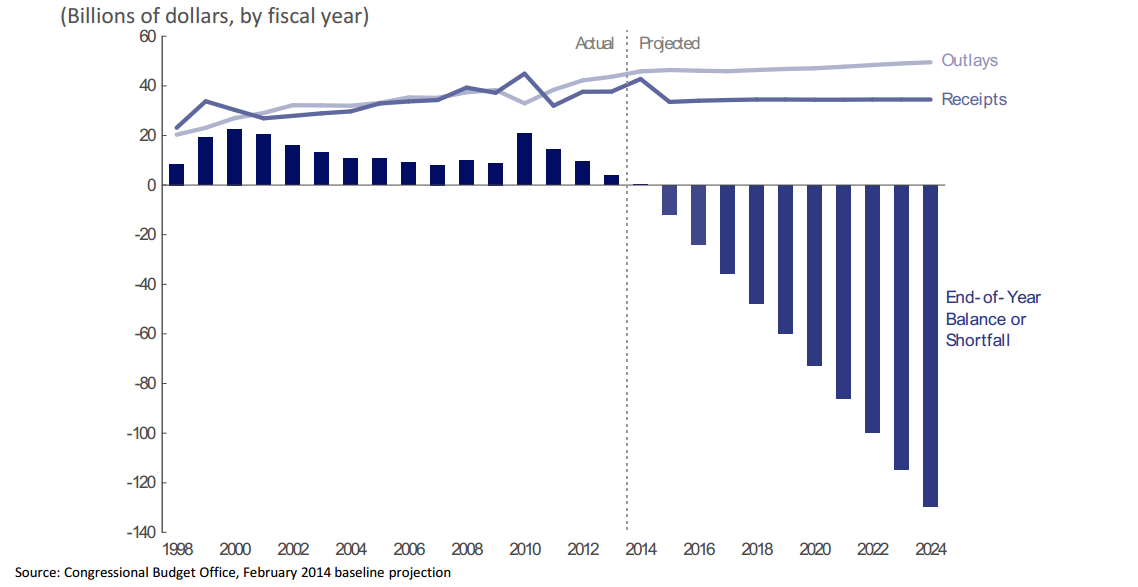

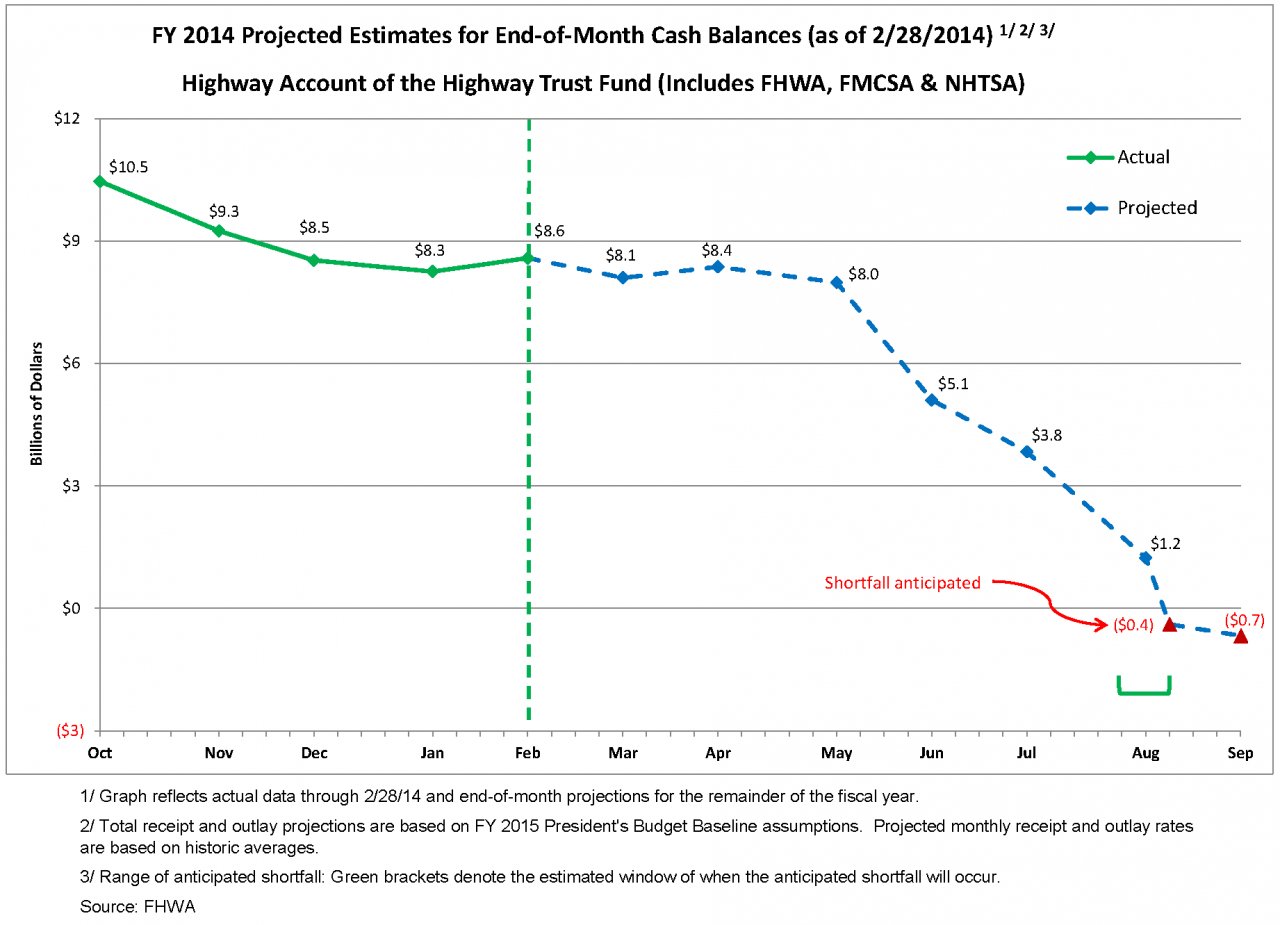

The CBO estimates that the highway account of the trust fund may have difficulty meeting all obligations during the latter half of fiscal year 2014. Additional details are available at: Testimony on the Status of the Highway Trust Fund

Highway Trust Fund Ticker

Based on current spending and revenue trends, the U.S. Department of Transportation estimates that the Highway Account of the Highway Trust Fund will encounter a shortfall before the end of fiscal year (FY) 2014. See USDOT HTF Ticker for more details.

Mobility Innovations and Pricing (MIP) is SCAG’s first study to emerge from the diversity, equity, and inclusion initiatives the organization has instituted during the past 18 months. This report focuses on the potential equity implications of road pricing and other innovative transportation policies in the six-county SCAG region. The initiative combines stakeholder engagement, technical analyses, and communications strategies to elevate equity considerations as a key touchstone in planning for road pricing—most critically leading with the concerns of underrepresented communities through dialogue with community stakeholder organizations.

The MIP initiative aims to surface the priorities of historically marginalized populations that disproportionately bear the negative economic, environmental, personal safety, and public health impacts of our transportation system. In addition to identifying transportation burdens and priority investments through a community-led engagement process, the project sought to analyze the travel needs of underrepresented communities. The project serves as foundational step towards understanding the equity implications of these strategies and increasing community participation in the policymaking process on these issues.

View the Report

For a more in-depth look into the community engagement process, technical analysis, and recommendations, please see the full report available below.

- Mobility Innovations and Pricing Report

- Appendix A: Sample Outreach Framework

- Appendix B: Sample Memorandum of Understanding

- Appendix C: Committee Surveys

- Appendix D: Virtual Engagement Guide

- Appendix E: Frequently Asked Questions

- Appendix F: Transit Funding Primer

Community Advisory Committee Workshops

SCAG is evaluating how value pricing can contribute to reducing congestion,improving air quality, and enhancing transportation revenues. SCAG aims to understand the ways in which value pricing, along with a variety of other congestion management approaches, can improve travel conditions in the region, and provide associated economic, and public health benefits. The analysis will evaluate various value pricing strategies to determine how they can help meet regional goals. SCAG will identify strategies and specific implementation actions that could be pursued over long-term.

Advancements in technologies enabling greater use of electric or alternative fuel vehicles will continue to impact gas tax revenues. The U.S. Energy Information Agency estimates that fuel efficiency for all light-duty vehicles (cars and light trucks) will steadily increase, from an average weighted MPG of just over 20 in 2010 to over 36 in 2040. The fuel efficiency of freight trucks also is expected to improve, although at a slower rate, from an average weighted MPG of over 6 in 2010 to over 8 in 2040. This projection assumes there is not a major paradigm shift in vehicle fuel technology, such as affordable electric cars or hybrid heavy-duty trucks. It also assumes no shift will occur in public policy or public attitudes that encourage people to reduce their long-term travel habits or shift to more efficient vehicles more quickly. Given the growing concern about climate protection and fuel price volatility, however, such changes are likely, which would lead to a more rapid deterioration in the long-term viability of the current fuel tax.

SCAG projections indicate that the total number of vehicle miles traveled in the SCAG region will increase by about 16 percent by 2035. The National Surface Transportation Infrastructure Financing Commission also predicts an increase in VMT nationwide. The Financing Commission evaluated a combination of short- and long-term factors, identifying that short-term motor fuel price volatility combined with a weak economy could have a considerable negative impact. They indicate that despite a recent national decline in VMT, travel growth nationally will resume a trajectory of about 1.5 to 1.8 percent per year for the foreseeable future due to factors such as population growth, economic growth, and land use patterns. Accordingly, the Financing Commissions’ findings and recommendations indicate that the most viable approach to efficiently fund investments in transportation in the medium to long run will be a user charge system based more directly on miles driven (and potentially on factors such as time of day, type of road, vehicle weight, and fuel economy) rather than indirectly on fuel consumed. Additionally, the National Surface Transportation Policy and Revenue Study Commission identified consistent findings and recommendations.

SCAG supports further research, development, and demonstration of mileage-based user fees specific to the Southern California context. SCAG is exploring partnerships with automobile manufacturers and technology developers, and local/regional business leaders in the development of a strategic action plan and initial demonstration framework.

Links to important Transportation Finance reports and studies.

- Alternative Approaches to Funding Highways

In Alternative Approaches to Funding Highways, the Congressional Budget Office (CBO) analyzes the effects of alternative approaches to funding highways. In particular, it compares the effects of current fuel taxes and of possible new taxes on the number of miles highway users drive. Some costs of highway use, such as those associated with emissions of greenhouse gases and the nation’s dependence on foreign oil, are directly related to fuel consumption. But the larger share of costs—for pavement damage, congestion, accidents, and noise—is more directly tied to the number of miles traveled. Therefore, having users pay the actual cost of their highway use would involve imposing a combination of fuel taxes and per-mile charges. Although such an approach would lead to more efficient use of highways, it would distribute the burden of highway funding somewhat differently than would fuel taxes alone. In keeping with CBO’s mandate to provide objective, impartial analysis, this study does not make any recommendations.

- 2011 Statewide Transportation System Needs Assessment

The Statewide Transportation Needs Assessment, prepared for the California Transportation Commission, details what is needed for California’s transportation system and how to pay for it. The overall goal of the Needs Assessment is to develop a coordinated list of transportation projects and programs, and to identify related funding requirements that will allow local, state, and regional transportation agencies in California to present a consistent message when communicating statewide needs for preserving, expanding, maintaining, and operating the state’s transportation system. The report is designed to address the needs of the statewide transportation system for the next ten years (2011 to 2020).

- Highway Trust Fund: Pilot Program Could Help Determine the Viability of Mileage Fees for Certain Vehicles

The U.S. Government Accountability Office (GAO)’s Highway Trust Fund: Pilot Program Could Help Determine the Viability of Mileage Fees for Certain Vehicles report notes that federal funding to build and maintain the nation’s highways and bridges comes primarily from highway users through federal fuel taxes. These revenues have eroded due to improvements in vehicle fuel efficiency and other factors contributing to shortfalls in the Highway Trust Fund. Experts have proposed alternative means of raising revenues by charging drivers fees based on their miles traveled. Several states have tested systems that gather vehicle mileage and location data, which has raised privacy concerns. GAO examined (1) the benefits and challenges of mileage fee initiatives in the United States and other selected nations, (2) mileage fee rates necessary to replace and supplement current Highway Trust Fund revenues and the effect these fees would have on users’ costs, and (3) state DOTs’ views on future revenue demands and mileage fees. GAO reviewed five domestic pilot projects and programs in Germany, New Zealand, and the Netherlands; modeled mileage fees for passenger vehicles and commercial trucks; and surveyed 51 state DOTs.

- Paying Our Way: A New Framework for Transportation Finance

SAFETEA-LU established the National Surface Transportation Infrastructure Financing Commission (Financing Commission) and charged it with analyzing future highway and transit needs and the finances of the Highway Trust Fund and making recommendations regarding alternative approaches to financing transportation infrastructure. The Financing Commission’s final report, Paying Our Way: A New Framework for Transportation Finance, offers a roadmap for sweeping reform of the nation’s transportation infrastructure funding and finance framework. The Financing Commission offers specific recommendations for increasing investment in transportation infrastructure while at the same time moving the Federal Government away from reliance on motor fuel taxes toward more direct fees charged to transportation infrastructure users.

- Transportation Funding in California

Transportation Funding in California, prepared by the California Department of Transportation (Caltrans), includes charts prepared as visual aids to show the sources and distribution of transportation funds in California. The dollar amounts, when readily available, show the relative magnitudes of different programs. They are not necessarily official figures and are subject to change. The amounts were obtained from different sources which may not always be consistent.

- Transportation for Tomorrow: Report of the National Surface Transportation Policy and Revenue Study Commission

Calling for a “new beginning” to reform the nation’s transportation programs, the bipartisan National Surface Transportation Policy and Revenue Study Commission’s final report, Transportation for Tomorrow: Report of the National Surface Transportation Policy and Revenue Study Commission, is a comprehensive plan to increase investment, expand services, repair infrastructure, demand accountability, and refocus Federal transportation programs, while maintaining a strong Federal role in surface transportation. Policy changes, though necessary, will not be enough on their own to produce the transportation system the Nation needs in the 21st century. Significant new funding also will be needed.

Links to important resources and related sites.

- California Transportation Commission (CTC)

The CTC is responsible for the programming and allocating of funds for the construction of highway, passenger rail, and transit improvements throughout California. The CTC also advises and assists the Secretary of Business, Transportation and Housing Agency and the Legislature in formulating and evaluating state policies and plans for California’s transportation programs. The CTC is also an active participant in the initiation and development of State and Federal legislation that seeks to secure financial stability for the State’s transportation needs.

- Federal Highway Administration (FHWA)

FHWA formula (non-discretionary) funding includes Congestion Mitigation and Air Quality (CMAQ) Program and Regional Surface Transportation Program (RSTP) funds. CMAQ Apportionments and RSTP Apportionments within California are available from Caltrans. The Transportation Alternatives Program (TAP) is a new program authorized under MAP-21. FHWA also administers a number of discretionary grant programs.

- Federal Highway Trust Fund

The Federal Highway Trust Fund (HTF) provides federal highway and transit funding from a nationally imposed fuel tax of 18.3 cents per gallon on gasoline and 24.4 cents per gallon on diesel fuel. FHWA reports on the month to month balance of the HTF. The Congressional Budget Office (CBO) regularly provides longer-term status reports on the HTF.

- Federal Transit Administration (FTA)

FTA funding falls into two categories: formula and non-formula (discretionary). FTA Formula Programs include 5307 Urbanized Area Formula, 5310 Enhanced Mobility for Seniors and Individuals with Disabilities Formula, 5311 Formula Grants for Rural Areas, 5337 State of Good Repair Grants Formula, and 5339 Bus and Bus Facilities Program Formula. FTA Non-Formula Programs include 5309 Fixed Guideway Capital Investment Grants.

- Gas Excise Tax Subventions (to Cities and Counties)

Revenues from the gas tax deposited into the Highway Users Tax Account in the Transportation Tax Fund are apportioned by the California State Controller to cities and counties. These apportionments are provided for in Streets and Highways Code Sections 2104 to 2122.

- Innovative Financing

Innovative finance is a broadly defined term that encompasses a combination of techniques and specially designed mechanisms to supplement traditional financing sources and methods. Innovative finance for transportation includes such measures as:

- New or non-traditional sources of revenue

- New financing mechanisms designed to leverage resources

- New fund management techniques

- New institutional arrangements

The FHWA Office of Innovative Program Delivery provides tools, expertise and financing to help the transportation community explore and implement innovative strategies to deliver costly and complex infrastructure projects. The FHWA Resource Center Innovative Finance Technical Service Team provides a complete range of services to financial officials at state, local, and Federal Highway Administration Division offices. The Caltrans Office of Innovative Finance – Division of Budgets maximizes available resources by exploring and utilizing traditional and innovative financing strategies.

- Local Option Sales Tax Measures

Revenues are derived from locally imposed ½ percent sales taxes for select counties. Imperial, Los Angeles, Orange, Riverside, and San Bernardino Counties currently have sales tax measures dedicated to transportation expenditures.

Most local sales tax measures are for a limited term, but all continue through the 2012-2035 RTP/SCS planning period. Imperial County Measure D continues through 2050, Orange County Measure M continues through 2041, Riverside County Measure A continues through 2039, and San Bernardino County Measure I continues through 2040. Los Angeles County levies a permanent 1 percent tax (a combination of two ½ percent sales taxes—Proposition A and Proposition C). In addition, Los Angeles County Measure R provides a temporary, additional ½ percent sales tax (on top of the existing, permanent 1 percent sales tax) and continues through 2039. Ventura County is the only county in the SCAG region without a local sales tax measure.

The California State Board of Equalization reports Payments to Special Districts and the Transactions (Sales) and Use Taxes, which include local option sales tax measure revenues.

- Moving Ahead for Progress in the 21st Century Act (MAP-21)

MAP-21 is the successor transportation authorization replacing SAFETEA-LU and funds surface transportation programs for fiscal years (FY) 2013 and 2014. MAP-21 specific sites include:

- U.S. Department of Transportation: http://www.dot.gov/map21

- Federal Highway Administration: http://www.fhwa.dot.gov/map21/

- Proposition 1B

As approved by the voters in the November 2006 general elections, Proposition 1B enacts the Highway Safety, Traffic Reduction, Air Quality, and Port Security Bond Act of 2006 to authorize $19.925 billion of state general obligation bonds for specified purposes, including high-priority transportation corridor improvements, State Route 99 corridor enhancements, trade infrastructure and port security projects, school bus retrofit and replacement purposes, state transportation improvement program augmentation, transit and passenger rail improvements, state-local partnership transportation projects, transit security projects, local bridge seismic retrofit projects, highway-railroad grade separation and crossing improvement projects, state highway safety and rehabilitation projects, and local street and road improvement, congestion relief, and traffic safety.

- State Fuel Tax Swap

The Fuel Tax Swap provides for a combination of lowering the sales and use tax rate applicable to sales of motor vehicle fuel, excluding aviation gasoline, and simultaneously raising the state excise motor vehicle fuel tax, effective July 1, 2010. Additionally, the Fuel Tax Swap raises the sales tax rate applicable to sales of diesel fuel and simultaneously lowers the state excise tax on diesel fuel, effective July 1, 2011. The California State Board of Equalization (BOE) is required to adjust the excise tax rates for both motor vehicle fuel and diesel fuel annually so that the total amount of tax revenue generated is equal to what would have been generated had the sales and use tax and excise tax rates remained unchanged.

- State Highway Operation and Protection Plan (SHOPP)

The SHOPP is a four-year program that provides funding from the State Highway Account (SHA) to be used for projects that reduce collisions and hazards to motorists, preserve and rehabilitate bridges and roadways, enhance and protect roadsides, and improve the operation of the State Highway System. It does not include projects that increase the capacity of the transportation system. SHOPP revenues are taken “off the top” before allocations are made for the STIP.

- State Transit Assistance Fund (STA)

The STA is derived from the statewide sales tax on diesel fuel. STA funds are appropriated by the Legislature to the California State Controller’s Office. That Office then allocates the tax revenue, by formula, to planning agencies and other selected agencies. Statute requires that 50 percent of STA funds be allocated according to population and 50 percent be allocated according to operator revenues from the prior fiscal year.

- State Transportation Improvement Program (STIP)

The STIP is a five-year capital improvement program that provides funding from the State Highway Account (SHA) for projects that increase the capacity of the transportation system. The SHA is funded through a combination of state gas excise tax, the Federal Highway Trust Fund, and truck weight fees. The STIP may include projects on state highways, local roads, intercity rail, or public transit systems. The Regional Transportation Planning Agencies (RTPAs) propose 75 percent of STIP funding for regional transportation projects in Regional Transportation Improvement Programs (RTIPs). Caltrans proposes 25 percent of STIP funding for interregional transportation projects in the Interregional Transportation Improvement Program (ITIP).

- Transit Farebox Revenue

Transit farebox revenue data is available from the California State Controller’s Office Transit Operators and Non-Transit Claimant Annual Report and National Transit Database Annual Transit Profiles.

- Transportation Development Act (Local Transportation Fund)

The Transportation Development Act (TDA) provides two major sources of funding for public transportation—the Local Transportation Fund (LTF) and the State Transit Assistance Fund (STA). LTF revenues are derived from a quarter-cent sales tax on retail sales statewide. Funds are returned to the county of tax generation. This category includes Article 3, 4, 4.5, and 8 of the Government Code. In the SCAG region, TDA funds are used mostly for transit operations and transit capital expenses. Article 3 funds support bicycle and pedestrian facilities.

The California State Board of Equalization reports Payment to County Transportation Funds from the 1/4 Percent Local Sales and Use Tax, which include LTF revenues

Mobility Innovations and Pricing (MIP) is SCAG’s first study to emerge from the diversity, equity, and inclusion initiatives the organization has instituted during the past 18 months. This report focuses on the potential equity implications of road pricing and other innovative transportation policies in the six-county SCAG region. The initiative combines stakeholder engagement, technical analyses, and communications strategies to elevate equity considerations as a key touchstone in planning for road pricing—most critically leading with the concerns of underrepresented communities through dialogue with community stakeholder organizations.

SCAG is evaluating how value pricing can contribute to reducing congestion,improving air quality, and enhancing transportation revenues. SCAG aims to understand the ways in which value pricing, along with a variety of other congestion management approaches, can improve travel conditions in the region, and provide associated economic, and public health benefits. The analysis will evaluate various value pricing strategies to determine how they can help meet regional goals. SCAG will identify strategies and specific implementation actions that could be pursued over long-term.

Advancements in technologies enabling greater use of electric or alternative fuel vehicles will continue to impact gas tax revenues. The U.S. Energy Information Agency estimates that fuel efficiency for all light-duty vehicles (cars and light trucks) will steadily increase, from an average weighted MPG of just over 20 in 2010 to over 36 in 2040. The fuel efficiency of freight trucks also is expected to improve, although at a slower rate, from an average weighted MPG of over 6 in 2010 to over 8 in 2040. This projection assumes there is not a major paradigm shift in vehicle fuel technology, such as affordable electric cars or hybrid heavy-duty trucks. It also assumes no shift will occur in public policy or public attitudes that encourage people to reduce their long-term travel habits or shift to more efficient vehicles more quickly. Given the growing concern about climate protection and fuel price volatility, however, such changes are likely, which would lead to a more rapid deterioration in the long-term viability of the current fuel tax.